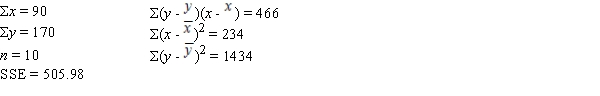

A regression and correlation analysis resulted in the following information regarding a dependent variable (y) and an independent variable (x) .  The sample correlation coefficient equals

The sample correlation coefficient equals

Definitions:

Common Law

A collection of laws that are not codified but are founded on judicial decisions made by courts.

Equity

A branch of law that deals with justice and fairness, providing remedies and relief that are not available in the regular legal system.

Legal System

The comprehensive framework of laws, regulations, and procedures that guide the administration of justice in a society.

Bills

Bills typically refer to statements of money owed for goods or services provided, or alternatively, drafts of proposed legislation before they become law.

Q1: If two variables, x and y, have

Q2: The mean square is the sum of

Q27: You are given the following information about

Q28: Part of an ANOVA table is shown

Q34: A population consists of 15 items. The

Q45: A juice drink filling machine, when in

Q46: A 95% confidence interval for a population

Q58: The maximum number of defective items that

Q61: In order to estimate the average electric

Q74: In a completely randomized experimental design involving