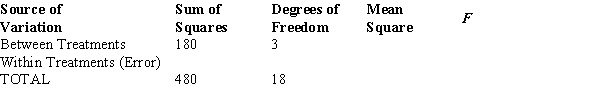

Part of an ANOVA table is shown below.  The test statistic is

The test statistic is

Definitions:

Efficient Frontier

A concept in modern portfolio theory representing a set of optimal investment portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return.

Capital Asset Pricing Model

A model that describes the relationship between systemic risk and expected return for assets, particularly stocks, used to calculate a theoretically appropriate required rate of return for an asset, given its non-diversifiable risk.

Expected Rate

The anticipated return on an investment based on historical averages, interest rates, or economic indicators.

Illiquidity Premiums

Additional return expected by investors for holding assets that are difficult to trade quickly without significant price concessions.

Q3: The results of a recent poll on

Q12: At α = .01, test to determine

Q13: The Spearman rank-correlation coefficient for 25 pairs

Q21: The test statistic for goodness of fit

Q34: Last school year, the student body of

Q40: An insurance company selected samples of clients

Q54: Of the two production methods, a company

Q67: In a lower tail hypothesis test situation,

Q70: The sample statistic, such as <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6985/.jpg"

Q71: A random sample of 1000 people was