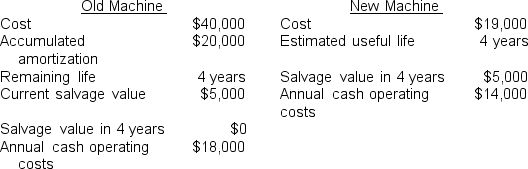

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x5, $5,700 in 20x6, $3,800 in 20x7, and $1,900 in 20x8. Assume Bailey would purchase the new machine in December 20x4 and dispose of the old machine in January 20x5.

The net cash flow associated with selling the old machine in January 20x5 (i.e., the value of the sale and any tax consequences) would be:

Definitions:

Lease Period

The duration for which a lease agreement between a lessor and lessee is valid, typically specified in the contract.

Implied Warranty of Possession

A legal guarantee that the seller of a property has the right to transfer ownership without any claims from third parties.

Periodic Tenancy

A leasehold interest in property that continues for successive periods (e.g., month-to-month, year-to-year) until terminated by either party.

Eviction Action

A legal process initiated by a landlord to remove a tenant from a property due to violations of the rental agreement.

Q7: Theft of raw materials is most likely

Q11: Titan Company, a distributor of high quality

Q27: When an organization sells more than one

Q46: Which of the following is trigonal planar?<br>A)

Q49: A firm is currently buying a part

Q78: Single-rate allocation methods use only one cost

Q91: Which of the following is a polar

Q92: Which of the following is most likely

Q95: If the internal rate of return exceeds

Q105: The Kelso Division produces and sells