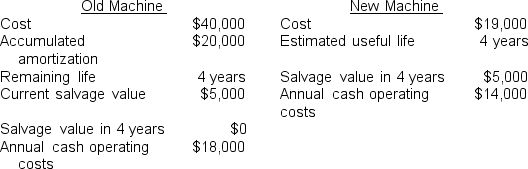

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x5, $5,700 in 20x6, $3,800 in 20x7, and $1,900 in 20x8. Assume Bailey would purchase the new machine in December 20x4 and dispose of the old machine in January 20x5.

The net cash flow associated with selling the old machine in January 20x5 (i.e., the value of the sale and any tax consequences) would be:

Definitions:

Absolute Income Scale

A measure of an individual’s or household’s income level, without adjusting for inflation or cost-of-living differences.

Poverty Line

A defined income threshold below which individuals or families are considered to be living in poverty, contextual to each country's standard of living and cost of living.

In-Kind Transfers

Transfers of goods or services from one party to another as a form of payment or aid, rather than transferring cash.

Economic Pie

A metaphorical representation of a nation's total economic output, suggesting how much wealth is available for distribution among its population.

Q6: Participative budgeting:<br>I. Occurs from the bottom up<br>II.

Q6: Provide a neatly drawn figure to show

Q13: Managers need information from current beginning inventories

Q22: The market share variance reflects the difference

Q23: J-M Company uses a joint process

Q24: Market-based prices are influenced by all of

Q37: The yield variance is unfavourable when less

Q48: When does Kaizen costing typically occur?<br>A) Before

Q89: (Appendix 10A) To prepare a cash budget,

Q124: Standard costs should be reviewed:<br>A) Daily<br>B) Monthly<br>C)