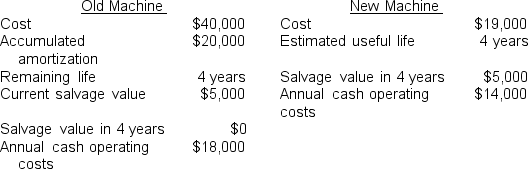

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x5, $5,700 in 20x6, $3,800 in 20x7, and $1,900 in 20x8. Assume Bailey would purchase the new machine in December 20x4 and dispose of the old machine in January 20x5.

The relevant annual pretax cash operating cost associated with Bailey's decision will be:

Definitions:

Incentives

Are extrinsic or intrinsic rewards or penalties for performing an action or refraining from one, motivating behavior change.

K-12 School Year

The educational period or academic years that include kindergarten through 12th grade in many countries, marking the compulsory stages of schooling.

Resources Are Scarce

The economic principle that the amounts of natural resources, goods, and services available are limited in relation to the desires and needs of people.

Households

The basic economic unit of a society, typically consisting of people living together in the same dwelling.

Q3: Which of the following is not a

Q7: A major drawback of cost-based pricing is

Q12: A supplier of Titan pens has released

Q39: TFS Corporation, a retail company selling

Q49: Kaizen costing is similar to a budget

Q65: Support department costs are always allocated to

Q85: HGT Corporation produces four products from a

Q92: Which of the following is a tertiary

Q119: J-M Company uses a joint process

Q121: Bellingham, Inc. incurred the following during