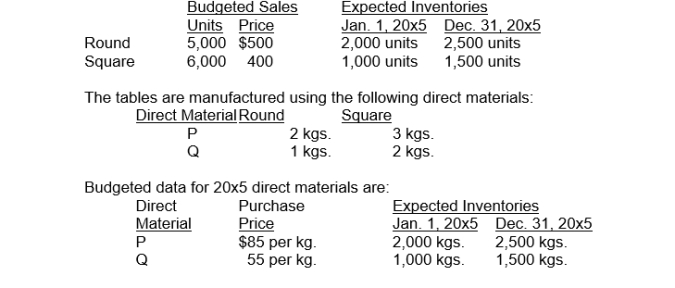

Horton Company produces and sells two products: round and square tables. In August 20x4, the budget projected the following for 20x5:  Budgeted data for 20x5 direct labour and overhead are:

Budgeted data for 20x5 direct labour and overhead are:

Direct labour:

Round 4 hours per unit at $6 per hour

Square 6 hours per unit at $8 per hour

Overhead: $4 per direct labour hour

Total budgeted production of tables in 20x5 is:

Definitions:

Variable Cost

Expenses that fluctuate in direct proportion to changes in output or activity level, including costs like supplies and commission fees.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including the cost of the materials and labor used in production.

Opportunity Cost

The expense incurred by not choosing the second-best option available during decision-making.

Product Costs

The total costs directly involved in manufacturing a product, including material, labor, and overhead expenses.

Q2: PIR Corporation has 2 support departments and

Q3: Which of the following is not a

Q9: BBM Corporation's managers are attempting to build

Q18: Quick Start Engines has two departments,

Q28: Costs incurred after the split-off point are

Q67: Variance analysis is used for monitoring and

Q88: The cost categories that are measured and

Q89: The standard cost of direct materials is

Q92: Unlike activity-based costing, traditional costing systems never

Q122: Which of the following variances is least