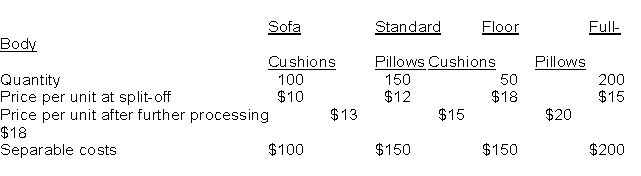

HGT Corporation produces four products from a common production process. Selected data from HGT's accounting system for the four products appears below:  Joint costs for the accounting period totalled $5,000. Each product line has a different product manager who is evaluated based on product line profitability. Therefore each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Joint costs for the accounting period totalled $5,000. Each product line has a different product manager who is evaluated based on product line profitability. Therefore each manager is motivated to reduce his / her total product line costs as much as possible. The managers have been given information about potential joint cost allocations using the following three methods: physical output, sales at split-off point, and net realizable value. The managers are comparing the joint cost allocations under each method so that they can give the accountant input about their preferred method(s) .

Which product line would receive the least amount of joint cost under the physical output method?

Definitions:

Invoice Date

This is the date on which an invoice is issued, marking the point when the seller officially requests payment from the buyer for goods or services provided.

Terms of Sale

Conditions agreed upon by a buyer and seller regarding the purchase, including payment and delivery conditions.

Credit Analysis

The process of determining the probability that customers will or will not pay.

Payables Policy

The guidelines a company follows regarding how and when it will pay its bills and invoices to creditors.

Q9: A capital investment's expected useful life is

Q13: Materials are added at the beginning of

Q25: The sales price variance is calculated as

Q31: Everett, Inc. budgeted $1,488,000 for total overhead.

Q40: Governments often require the following type of

Q73: Benjamin Company invested in a 3-year project

Q74: DBR Corporation is considering the purchase and

Q78: <span class="ql-formula" data-value="\begin{array}{lccc}&\text { Direct }&\text {Direct}&\text

Q95: A formalized financial plan for organizational operations

Q96: Calculating variances is a necessary, but not