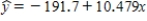

In a study of the bidding behavior when antique grandfather clocks are sold at auction, investigators analyzed the selling price (y) and the age in years of the grandfather clock (x). Summary quantities from this analysis yield: n = 32  Sxx = 23625.9

Sxx = 23625.9  se = 273.03

se = 273.03

a) Calculate the estimated standard deviation of a + bx* for x* = 150.

b) For what value x* is the estimated standard deviation of a + bx* smallest, and why?

Definitions:

Unipolar Depression

A major depressive disorder characterized by a persistent feeling of sadness or a lack of interest in outside stimuli.

Diagnosable Symptoms

Observable signs and symptoms that can be identified and used to diagnose a particular medical condition or disease.

Major Depressive Episode

A period characterized by a severely depressed mood or a loss of interest or pleasure in daily activities, lasting for at least two weeks, along with other symptoms.

Melancholic

Pertaining to melancholy, a mood disorder characterized by feelings of deep sadness, despondency, and pessimism.

Q3: The principle of "data hiding" is the

Q23: The basketball team at North Snowshoe High

Q25: As part of the foraging behavior assessment

Q27: The standard deviation of the distribution of

Q39: The Iowa Tests of Basic Skills is

Q41: Researchers study the relationship between x =

Q42: For both large and small samples the

Q54: In the following code block, which of

Q66: What is the cost of sales for

Q81: If the spot rate for the Japanese