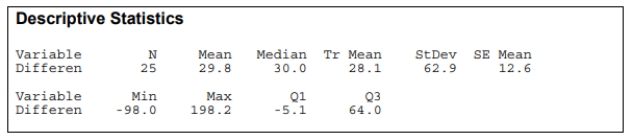

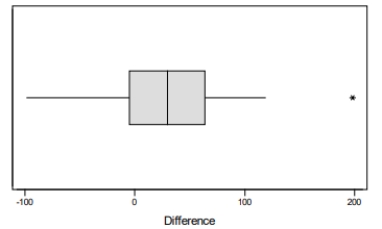

Assume you obtained a MINITAB output and a boxplot of differences between the number of fish at a depth of 5 meters and 10 meters.

Choose the correct statement.

Choose the correct statement.

Definitions:

Static Hedging

A financial strategy that involves setting up a position in options or other securities to mitigate risk, without needing to adjust the position frequently.

Capital Outlay

The amount of money spent on acquiring or improving fixed assets, such as buildings, equipment, and land.

Black-Scholes Option-pricing Model

A mathematical model for pricing European call and put options, using factors like the stock's price, exercise price, risk-free rate, and time to expiration.

Dividend Payouts

Distributions made to shareholders by a company, typically from earnings.

Q3: When planning for the big Statistics Department

Q3: Financial middlemen include _.<br>A) securities brokers<br>B) securities

Q14: A major disadvantage of a sole proprietorship

Q19: Stockholder's equity is also known by another

Q23: The scatter plot and residual plot shown

Q33: Replicating in an experiment means that the

Q34: Briefly explain what it means when two

Q43: The barriers to the free flow of

Q44: _ deals with economic decisions of individuals,

Q54: In a forensic study of the relation