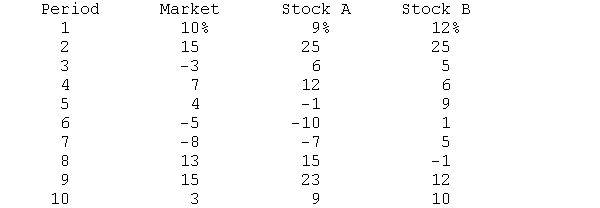

This problem illustrates the computation of beta coefficients may be solved using a statistics program or Excel.) The returns on the market and stock A and stock B are as follows:

Compute the beta coefficient for each stock and interpret the results of the computations.

Definitions:

Bales

Large bundles or packages of material, most commonly used in reference to agriculture commodities like hay or cotton.

Profit-maximizing

In economics, this refers to the process by which a firm determines the price and output level that returns the greatest profit.

Profit

is the financial gain realized when the revenue generated from business activities exceeds the expenses, costs, and taxes needed to sustain the activity.

Breaks Even

The point at which total costs and total revenue are equal, leading to no net loss or gain for a business.

Q5: The price to sales ratio may be

Q12: Income taxation on the interest earned from

Q22: If a firm operates at a loss,

Q26: The Federal Reserve is the central bank

Q36: A high-yield bond has the following terms:<br>

Q37: Increases to assets are recorded on the

Q42: The rate of return on a stock

Q48: Which of the following is NOT part

Q50: Unsystematic risk is<br>A) the risk associated with

Q58: Which of the following does not appear