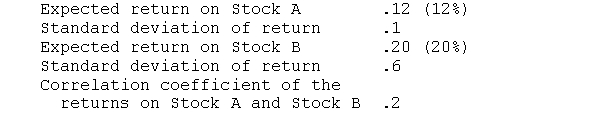

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios:

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were ?0.6 instead of 0.2?

Definitions:

Polygenic

Relating to or resulting from the influence of multiple genes, especially with regard to traits that exhibit a continuous distribution in the population.

Skin Color

The pigmentation of the skin, primarily determined by genetic inheritance influencing the amount and type of melanin produced.

Height

The measurement of someone or something from base to top or from the ground to a designated top point, expressing vertical dimension.

Blood Type AB

A human blood group characterized by the presence of both A and B antigens on the surface of red cells, making it the universal recipient type in blood transfusion.

Q5: Since closed-end investment companies acquire<br>Securities in efficient

Q13: Low beta stocks tend to generate higher

Q18: As the length of time to maturity

Q21: The prices of low coupon bonds tend

Q25: If a customer receives goods that are

Q28: Hedge funds follow investment strategies such as<br>A)

Q31: Which of the following would cause the

Q32: An income statement enumerates of an individual's

Q33: High tax efficiency suggests that a fund's

Q70: The relationship between a firm and its