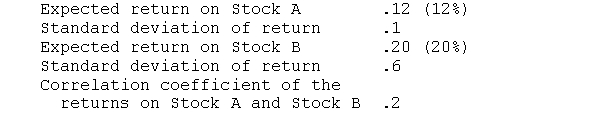

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios:

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were ?0.6 instead of 0.2?

Definitions:

Rule of Reciprocity

A social norm that suggests individuals respond to positive actions with other positive actions, fostering mutual benefit.

FMOT

The "First Moment of Truth," a marketing term referring to the first interaction between a customer and a product on the store shelf or online, crucial for making a good impression.

FMOT

First Moment of Truth; a marketing concept referring to the first time a consumer encounters a product and forms an impression.

Sustainability

The principle of meeting current needs without compromising the ability of future generations to meet their own, often focusing on environmental, economic, and social balance.

Q12: Efficient markets suggests that investors will outperform

Q14: Inflation, which is a general decline in

Q16: Gross domestic product (GDP) is the sum

Q16: If an investor buys shares in a

Q19: Closed?end investment companies<br>1) have a fixed capital

Q29: If the Federal Reserve sells securities, that

Q34: The chart of accounts is _.<br>A) static<br>B)

Q38: A call feature will have no impact

Q48: Exchange rate risk refers to fluctuations in

Q49: A fallen angel is<br>A) a quality bond