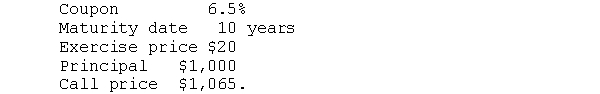

A firm has both a convertible bond and a convertible preferred stock outstanding. The convertible bond has the following features:

The convertible preferred stock has the following features:

Annual dividend $2.25

Convertible into 2.5 shares of common stock

Callable at $25 a share.

Currently the common stock is selling for $13; the yield on non?convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock? What would be the value of each security if it lacked the conversion feature?

SOLUTIONS TO THE PROBLEMS

Definitions:

Restricting Type

Refers to a subtype of anorexia nervosa characterized by severe restriction of calorie intake without engaging in binge-eating or purging behavior.

Bulimia Nervosa

An eating disorder characterized by episodes of binge eating followed by compensatory behaviors, such as vomiting or excessive exercise, due to an overconcern with body shape and weight.

Anorexia

An eating disorder characterized by an abnormally low body weight, intense fear of gaining weight, and a distorted perception of body weight or shape.

Normal Weight

A weight range considered healthy for a person's height, typically based on Body Mass Index (BMI) measurements.

Q6: Portfolio risk encompasses<br>1) a firm's financing decisions<br>2)

Q32: According to the efficient market hypothesis, purchasing

Q34: The time period to expiration for call

Q36: Put-call parity explains why a change in

Q42: The rate of return on a stock

Q46: A Euro?bond is denominated in the currency

Q61: A times?interest?earned of 0.9 means that interest

Q75: Brigg Enterprises produces miniature parasols. Each parasol

Q182: The opportunity cost of an alternate course

Q222: A managerial accountant<br>1) does not participate in