Given the information below, answer the following questions.

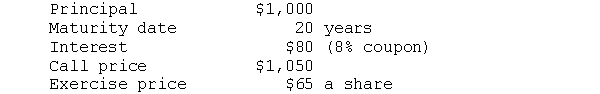

A convertible bond has the following features:

a. The bond may be converted into how many shares?

b. If comparable non-convertible debt offered an annual yield of 12 percent, what would be the value of this bond as debt?

c. If the stock were selling for $52, what is the value of the bond in terms of stock?

d. Would you expect the bond to sell for its value as debt (i.e., the value determined in b) if the price of the stock were $52?

e. If the price of the bond were $960, what are the premiums paid over the bond's value as stock and its value as debt?

Definitions:

American Military

The armed forces of the United States, comprising the Army, Navy, Marine Corps, Air Force, and Coast Guard, tasked with defending the country, protecting its interests abroad, and ensuring national security.

Annexed

The process by which a territory is legally incorporated into another geographical entity, often following conquest, purchase, or treaty.

Page Law

The first restrictive federal immigration law in the United States, passed in 1875, which prohibited the entry of Chinese women suspected of prostitution, aiming to limit the Chinese population.

Chinese Prostitutes

A term that refers to women of Chinese origin involved in sex work, often highlighted in discussions of immigration, exploitation, and historical racism.

Q9: A bond's call feature may be exercised

Q10: If the investor anticipates that the price

Q10: Entering a futures contract to sell corn

Q10: The sum of cash, currency, and demand

Q23: Municipal bonds are registered with the Federal

Q28: Corporation HBM has a convertible bond with

Q41: If an investor constructs a covered call,<br>A)

Q59: When an investor purchases a bond, he

Q85: The quick ratio is a better measure

Q188: Renee Company has old inventory on hand