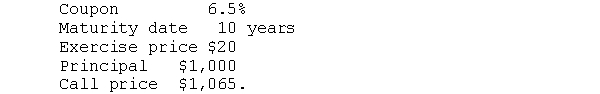

A firm has both a convertible bond and a convertible preferred stock outstanding. The convertible bond has the following features:

The convertible preferred stock has the following features:

Annual dividend $2.25

Convertible into 2.5 shares of common stock

Callable at $25 a share.

Currently the common stock is selling for $13; the yield on non?convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock? What would be the value of each security if it lacked the conversion feature?

SOLUTIONS TO THE PROBLEMS

Definitions:

Nutrients

Substances obtained from food that are vital for growth, maintenance of the body, and energy supply.

Estuaries

Coastal water bodies where freshwater from rivers and streams mixes with saltwater from the ocean, creating an ecologically rich environment.

Salinity

The concentration of dissolved salts in water, affecting the density, biodiversity, and chemical behavior of aquatic environments.

Fluctuation

A variation or change in a state, quantity, or level, often without a set pattern or rhythm.

Q11: You bought a stock for $20 and

Q14: The return on assets employs operating income

Q22: If a firm operates at a loss,

Q23: Deflation is a period of rising employment.

Q26: Analysis of preferred stock uses<br>A) operating income

Q29: The Wilshire 5000 stock index is more

Q29: The use of P/E ratios to select

Q42: A call option is similar to a

Q83: As times?interest?earned increases,<br>A) bondholders' position deteriorates<br>B) net

Q117: The net present value method can only