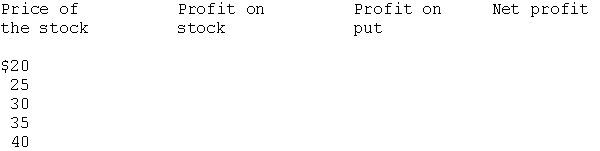

A put and a call have the following terms:

Call: strike price $30

term three months

price $3

Put: strike price $30

term three months

price $4

The price of the stock is currently $29. You sell the stock short and purchase the call. Complete the following table and answer the questions.

a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

Definitions:

Reverse Split

A reduction in the number of a company's shares outstanding that increases the share price proportionately.

Stock Dividend

A stock dividend is a dividend payment made to shareholders in the form of additional shares rather than a cash payout, affecting the shareholder's portion of company ownership but not the total value of ownership.

Stock Split

A corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares, though the overall value of the company does not change.

Dividend Decisions

The process by which a company's board of directors decides the amount and timing of payouts to shareholders from earnings.

Q2: You bought a stock for $28.29 that

Q5: Monetary and fiscal policy may affect stock

Q18: A stock's price will tend to fall

Q22: A price increase on small volume is

Q26: A $50 par value convertible preferred stock

Q34: The premium paid over a convertible bond's

Q43: A segment has the following data:

Q70: Crapty Company is considering investing in a

Q156: Ellen Company manufactures kitchen utensils. Bolla

Q202: The budgeted overhead costs for standard hours