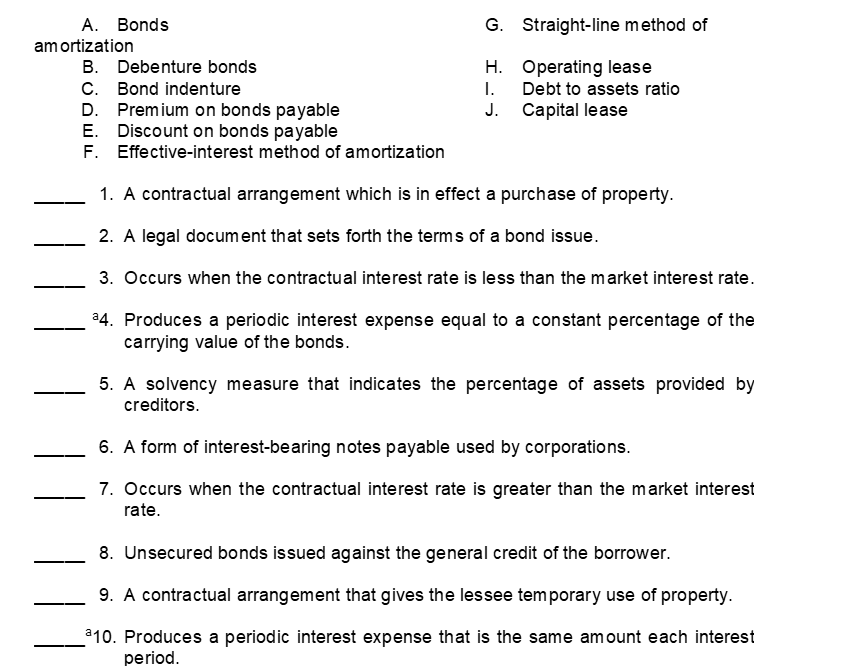

Match the items below by entering the appropriate code letter in the space provided.

Definitions:

AMT Purposes

Relates to calculations and exceptions specific to the Alternative Minimum Tax, aiming to prevent high-income taxpayers from avoiding substantial tax payments.

Personal Exemptions

A tax deduction allowed by the IRS for oneself and dependents, though it was eliminated for tax years 2018 through 2025 by the Tax Cuts and Jobs Act.

AMT Adjustments

Adjustments required for calculating the Alternative Minimum Tax, an alternative tax system designed to ensure that certain taxpayers pay at least a minimum amount of tax.

Standard Deduction

A fixed dollar amount that reduces the income that is subject to tax and varies according to the taxpayer's filing status.

Q10: Abbie's Organics Corporation began business in 2017

Q36: Cash dividends are not a liability of

Q51: The following accounts appear in the ledger

Q126: On February 1 Westwood Corporation issued 5000

Q131: Bonds are a form of interest-bearing notes

Q135: On January 1 2017 Maris Enterprises issued

Q163: If a corporation declares a 10% stock

Q171: River Forest Inc. has 5000 shares of

Q200: The operating activities section of the statement

Q208: Michelle receives $210000 and Stephanie receives $140000