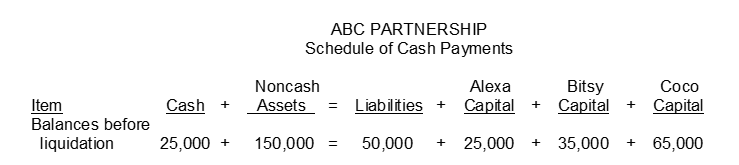

The ABC Partnership is to be liquidated and you have been hired to prepare a Schedule of Cash Payments for the partnership. Partners Alexa Bitsy and Coco share income and losses in the ratio of 4:3:3 respectively. Assume the following:

1. The noncash assets were sold for $70000.

2. Liabilities were paid in full.

3. The remaining cash was distributed to the partners. (If any partner has a capital deficiency assume that the partner is unable to make up the capital deficiency.)

Instructions

Using the above information complete the Schedule of Cash Payments below:

Definitions:

Dividend Income

Income received from owning shares in a company, which is often taxable at different rates than regular income.

Distribution

The action of sharing something out among a number of recipients, often used in the context of financial assets or dividends.

Transferors Own 80%

A situation in a business transaction where the original owners or transferors retain an 80% ownership interest in the property or entity after the transaction is completed.

Tax-Free

Earnings, income, or transactions that are not subject to tax by the government.

Q10: A gain or loss on disposal of

Q20: Under IFRS equity is described as each

Q26: The partners' income and loss sharing ratio

Q57: Farr Company purchased a new van for

Q61: Pellah (beginning capital $80000) and M. Berry

Q64: Working capital is<br>A) current assets plus current

Q120: On October 10 the board of directors

Q158: Selected data from a February payroll

Q168: The following totals for the month

Q296: Under the double-declining-balance method the depreciation rate