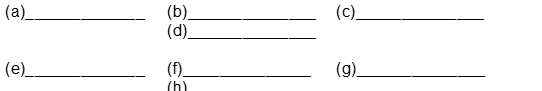

Fleming Company purchased a machine on January 1 2017. In addition to the purchase price paid the following additional costs were incurred: (a) sales tax paid on the purchase price (b) transportation and insurance costs while the machinery was in transit from the seller (c) personnel training costs for initial operation of the machinery (d) annual city operating license (e) major overhaul to extend the life of the machinery (f) lubrication of the machinery gearing before the machinery was placed into service (g) lubrication of the machinery gearing after the machinery was placed into service and (h) installation costs necessary to secure the machinery to the building flooring.

Instructions

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = Capital R = Revenue.

Definitions:

Structuring Work

The process of organizing tasks, roles, and responsibilities in a work environment to achieve efficiency and productivity.

Apportioning Time

The process of allocating or dividing time between different tasks, activities, or responsibilities.

Ending Meetings

The process of concluding a meeting by summarizing key points, assigning action items, and stating the next steps.

Program Activities

Planned events, tasks, or actions designed to achieve specific goals within a program or initiative.

Q20: Which one of the following is shown

Q32: The _ basis of estimating uncollectibles provides

Q33: The control principle related to not having

Q34: Compute Whiz Company's adjusted cash balance

Q51: The current portion of long-term debt should<br>A)

Q95: Retailers generally consider sales from the use

Q103: The percentage of receivables basis of estimating

Q118: Advances from customers are classified as a(n)<br>A)

Q212: Having different individuals receive cash record cash

Q216: Equipment that cost $420000 and on which