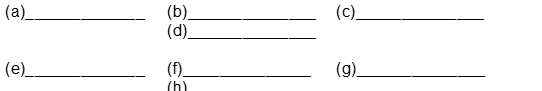

Fleming Company purchased a machine on January 1 2017. In addition to the purchase price paid the following additional costs were incurred: (a) sales tax paid on the purchase price (b) transportation and insurance costs while the machinery was in transit from the seller (c) personnel training costs for initial operation of the machinery (d) annual city operating license (e) major overhaul to extend the life of the machinery (f) lubrication of the machinery gearing before the machinery was placed into service (g) lubrication of the machinery gearing after the machinery was placed into service and (h) installation costs necessary to secure the machinery to the building flooring.

Instructions

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = Capital R = Revenue.

Definitions:

Time-Efficient

Refers to methods or strategies that are designed to achieve results or accomplish tasks in the shortest possible time without sacrificing quality.

Treatment Interventions

Strategies or actions designed to address and mitigate specific health or behavioral problems, often part of a broader treatment plan.

Life Experiences

Events, situations, or milestones that an individual encounters throughout their life, shaping their views, personality, and behavior.

Empathize

The capacity to understand and share the feelings of another person, essentially putting oneself in their shoes.

Q52: Allowing only designated personnel to handle cash

Q53: Notes or accounts receivables that result from

Q61: Pellah (beginning capital $80000) and M. Berry

Q107: An asset that cannot be sold individually

Q127: Match each of the following principles of

Q149: The custodian of the petty cash fund

Q163: Short-term notes receivables<br>A) have a related allowance

Q171: If the proceeds from the sale of

Q217: Zimmer Company sold the following two

Q272: The book value of a plant asset