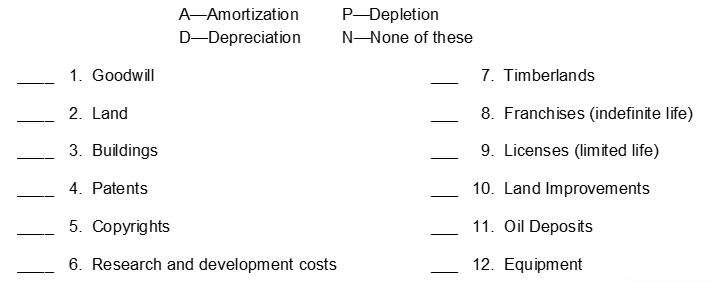

For each item listed below enter a code letter in the blank space to indicate the allocation terminology for the item. Use the following codes for your answer:

Definitions:

Nonsystematic Standard Deviation

A measure of variance in a portfolio's total returns attributable to factors specific to individual securities, as opposed to the market.

Equally-Weighted Portfolio

An equally-weighted portfolio is an investment strategy that gives the same weight, or importance, to each asset in the portfolio, regardless of the size or market value of the companies.

Securities

Securities that signify either an equity stake in a corporation that is publicly traded, a debt interest in a company or government entity, or ownership rights as delineated by an option.

HML Beta

A measure used in finance to assess the sensitivity of an asset or portfolio to a value factor, defined as high minus low book-to-market stocks.

Q36: The accounting for warranty cost is based

Q95: Maddy Peters's regular hourly wage rate is

Q142: The entry to replenish a petty cash

Q162: Bad Debt Expense is reported on the

Q165: The entry to record depletion<br>A) decreases owner's

Q205: The cash records of George Company show

Q208: The interest on a $8000 5% 90-day

Q223: In recording the sale of accounts receivable

Q232: The maturity date of a 1-month note

Q278: Accumulated Depletion<br>A) is used by all companies