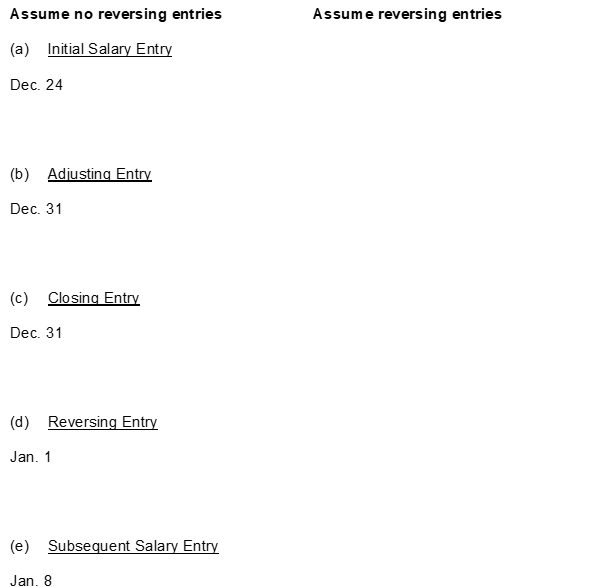

Transaction and adjustment data for Ortiz Company for the calendar year end is as follows:

1. December 24 (initial salary entry): $15000 of salaries earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries earned between December 25 and December 31 are $4500. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to $7000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries and the second set should assume that reversing entries are utilized by the company.

Definitions:

Probate Court

A specialized court that deals with the distribution of a deceased person's estate, including the validation of wills and resolution of contested issues.

Decedent's Estate

The total property, assets, and debts left behind by an individual at the time of their death.

Administration

In a business context, it refers to the process of managing and operating a business or organization; in a legal context, it could refer to managing the estate of a deceased person.

Equitable Title

A right to receive legal title to property upon fulfilling specific conditions, often related to contracts or trusts.

Q37: For each of the following determine

Q39: Qwik Company showed the following balances

Q67: The adjustments columns of the worksheet for

Q70: Unearned revenues are<br>A) cash received and a

Q73: An inexperienced accountant for Lamont Company made

Q132: Which of the following rules is incorrect?<br>A)

Q157: The time period assumption is often referred

Q212: Journalizing and posting closing entries is a

Q227: On December 31 2016 Fashion Nugget Company

Q234: Indicate the worksheet column (income statement