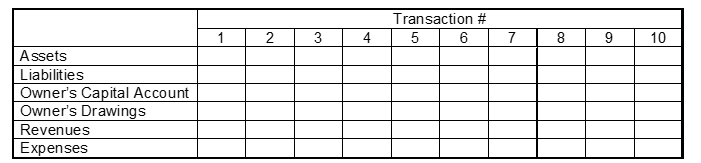

For each transaction given enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets liabilities and owner's equity accounts. In some cases there may be a "D" and a "C" in the same box.

Transactions:

1. Owner invests cash in the business.

2. Pays insurance in advance for six months.

3. Pays secretary's salary.

4. Purchases office supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. Owner withdraws assets from the business.

Definitions:

Book Value

The value of an asset according to its balance sheet account balance, taking into account the cost of the asset minus depreciation.

Fair Value

The estimated market price of an asset or liability in an orderly transaction between market participants at the measurement date.

Partial Equity Method

An accounting approach used when a company holds a significant influence, but not control, over an investee, recognizing a portion of the investee's income proportional to ownership stake.

Equipment Account

An account on the balance sheet representing the cost of equipment a company owns.

Q14: How does Excel's Solver help interpret reduced

Q46: Owner's capital at the end of the

Q67: Proprietorships partnerships and corporations<br>A) are the three

Q98: The owner's drawings account<br>A) appears on the

Q118: An accountant has debited an asset account

Q167: The monetary unit assumption requires that all

Q191: An analysis of the transactions made by

Q202: An adjusting entry always involves two balance

Q224: The organization(s) primarily responsible for establishing

Q250: Depreciation based on revaluation of land and