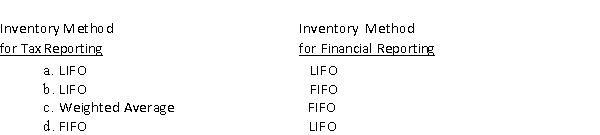

Federal income tax rules allow businesses to use different inventory costing methods for tax reporting and financial reporting with one exception.Which of the following situations is not allowed by federal income tax rules?

Definitions:

John Maynard Keynes

A British economist whose theories, known as Keynesian economics, had a major impact on modern economic and political theory as well as on fiscal policies of governments.

Supply Of Money

The total amount of money in circulation or in existence in a country.

Checking Deposits

Deposits in a bank account that can be withdrawn at any time without prior notice, typically used for day-to-day expenses.

Reserve Ratio

The percentage of deposits that banking authorities mandate a bank to keep as reserves, prohibiting them from being loaned out.

Q6: A company using the periodic inventory system

Q8: Forman, Inc.earned $600,000 profit during 2015.On which

Q35: The income statement of Hope Market, Inc.reported

Q38: Cook, Inc., a manufacturer of tires, has

Q87: If the balance on the bank statement

Q91: Depreciation does not describe the increase or

Q119: The key to the classification of an

Q126: If Paulson Transport continues to use the

Q134: Typically, the lower the accounts receivable turnover

Q149: All financial statements are prepared using the