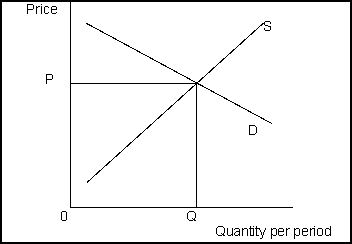

Use the following to answer question(s) : Model of a Competitive Market

-(Exhibit: Model of a Competitive Market) If there are external costs, a tax imposed on sellers will:

Definitions:

Absorption Costing

The accounting methodology that integrates all costs related to manufacturing, including direct materials, direct labor, and both forms of manufacturing overhead—variable and fixed—into a product's total cost.

Variable Costing

A financial tracking method that considers just the variable operating costs (direct materials, direct labor, and variable manufacturing overhead) in the pricing of merchandise.

Unit Product Cost

The overall expense incurred to manufacture a single item, encompassing direct materials, direct labor, and overhead costs.

Absorption Costing

Absorption costing is an accounting method that includes all of the manufacturing costs (direct materials, direct labor, and overhead) in the cost of a product.

Q9: According to the textbook, much of the

Q32: Market efficiency requires exclusive, but not transferable,

Q50: The amount by which an additional unit

Q59: (Exhibit: Demand for Shirts)The price elasticity of

Q91: In the long run, all costs are:<br>A)fixed.<br>B)constant.<br>C)variable.<br>D)marginal.

Q94: Suppose that the expected exam scores from

Q97: Which of the following is not true

Q105: If marginal cost is less than average

Q129: If along a given segment of a

Q139: Suppose that the price elasticity of demand