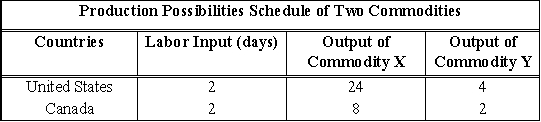

Use the following to answer question(s) : Production Possibilities Schedule for Two Commodities

-(Exhibit: Production Possibilities Schedule for Two Commodities) Assuming constant costs in the neighborhood of their current levels of production, the exhibit shows the number of units of commodity X each country would have to forgo to produce the additional units of commodity Y indicated.Further assume that the only input is labor and that it remains fully employed.If there were unrestricted trade and specialization according to the law of comparative advantage:

Definitions:

GDP Changes

The alterations in the Gross Domestic Product of a country, indicating the rate of growth or decline in the economy over a period.

Risk Premium

The extra return above the risk-free rate that investors require as compensation for the risk of an investment.

Simple CAPM

A model that describes the relationship between the risk of a security and its expected return, based on the premise that markets are efficient.

Risk-free Rate

The theoretical return on an investment with zero risk, typically represented by the yield on government bonds.

Q5: Regulation is an effort by government agencies

Q7: According to the text authors, the more

Q8: In general, the command-and-control approach to correcting

Q38: The first law designed to curb monopoly

Q42: The efficient level of pollution occurs where

Q73: The best example of a good for

Q84: Which of the following statements is true?<br>A)Discrimination

Q92: (Exhibit: Correcting for Market Failure: Imperfect Competition)Before

Q112: The best example of a merit good

Q115: The effort to change people's behavior by