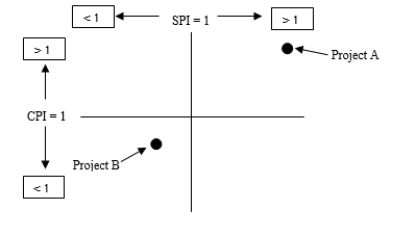

Given the following information about a project portfolio, what would be the most likely outcome associated with taking 10% of the resources from project A and giving them to project B? Assume the axis of the graph is the point where both CPI and SPI are equal to 1.

Definitions:

Debt

Money that is owed or due to be paid, typically resulting from borrowing funds to be repaid with interest.

Financial Leverage

Financial leverage is the use of borrowed money (debt) to amplify the potential returns from an investment or project.

Leverage

The use of borrowed funds to increase the potential return of an investment.

Optimal Capital Structure

The best mix of debt, preferred stock, and common equity that maximizes a company’s stock price while minimizing its cost of capital.

Q13: A team planning for the market

Q21: An approach that uses a number of

Q26: If the economy's short-run aggregate supply curve

Q31: There could be instances where the production

Q60: Refer to Figure 17-1.Which price level and

Q88: Using the internal rate of return method,

Q103: The process that produces sustained and widely

Q109: What budgeted amounts appear on the flexible

Q119: Which of the following factors contributed to

Q126: The investigation of a materials price variance