MegaTech Company has total monthly revenues of $325,000 and expenses of

$198,000 for the month ended July 31 before monthly adjusting entries are made. The following data are provided on the end of month adjustments to be made:

a. Insurance expired in July, $2,520.

b. Unbilled amounts to customers for July is $4,200.

c. Salaries earned by employees but not yet paid by MegaTech for the last week of July, $13,125.

d. Depreciation on equipment for July, $1,290.

e. Supplies used in July, $1,650.

f. Fees collected in advance from customers which have now been earned during

July, $23,400.

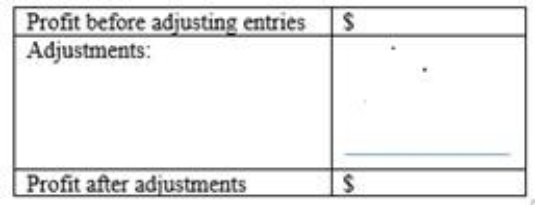

Complete the schedule below to determine the profit of MegaTech for July after these adjustments are recorded. Begin your schedule with income before

adjusting entries and then show the effect of each adjustment to arrive at profit

after adjustment.

Definitions:

Growth Determinant

A factor that is critical to the expansion of a company or economy, such as technology, capital, and human resources.

Retained Earnings

Profits that a company chooses not to distribute as dividends but instead reinvests into the business or uses to pay off debt, reflecting the accumulated surplus from business operations.

Dividend Payout Ratio

The fraction of net earnings a firm pays to its shareholders as dividends, usually expressed as a percentage.

Profit Margin

A measure of profitability calculated as net income divided by revenue.

Q9: During a period of steadily falling prices,

Q52: What account(s)is (are)affected by not recording the

Q58: A credit entry<br>A)Increases asset and expense accounts,

Q60: The timeliness principle assumes that an organization's

Q81: Blu Lightning Co. paid its employees $2,000

Q94: Expenses that support the overall operations of

Q96: The rules adopted by the accounting profession

Q99: By how much will net income for

Q126: If equipment were purchased from an outside

Q186: Using the schedule below, indicate the impact