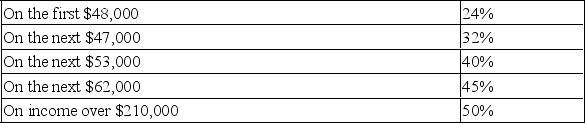

Steven earned $150,000 this year in profits from his proprietorship. Personal tax rates (federal plus provincial) in Steven's province are:

The combined federal and provincial rate of tax for Canadian-controlled private corporations in Steven's province is 13% on the first $500,000 of income.

The combined federal and provincial rate of tax for Canadian-controlled private corporations in Steven's province is 13% on the first $500,000 of income.

(All rates are assumed for this question.)

Steven has been considering incorporating his business.

Required:

A. How would Steven's after-tax profits have differed if the company had been incorporated? Show all calculations.

B. Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Impoverished Manager

An impoverished manager adopts a low concern for both people and production, minimizing involvement in leadership duties and often resulting in a lack of innovation and motivation within teams.

Initiating Structure

Leader behavior aimed at defining and organizing work relationships and roles, as well as establishing clear patterns of organization, communication, and ways of getting things done.

Work Relationships

The interpersonal connections and interactions that occur between individuals in a professional setting.

Executive Coaching

A personalized developmental process for business leaders to enhance their leadership skills and performance.

Q1: Joe invested in a piece of land

Q2: Which of the following attitudes and actions

Q7: Which of the following statements regarding partnerships

Q10: The purpose of the kidneys is to<br>A)

Q11: If actual overhead is less than applied

Q19: Actual manufacturing overhead costs are assigned to

Q44: Barton Company has beginning work in process

Q61: If Manufacturing Overhead has a debit balance

Q100: At physiological pH, phosphate esters, such as

Q113: In the month of April, a department