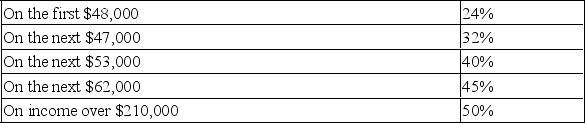

Steven earned $150,000 this year in profits from his proprietorship. Personal tax rates (federal plus provincial) in Steven's province are:

The combined federal and provincial rate of tax for Canadian-controlled private corporations in Steven's province is 13% on the first $500,000 of income.

The combined federal and provincial rate of tax for Canadian-controlled private corporations in Steven's province is 13% on the first $500,000 of income.

(All rates are assumed for this question.)

Steven has been considering incorporating his business.

Required:

A. How would Steven's after-tax profits have differed if the company had been incorporated? Show all calculations.

B. Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Major Depressive Disorder

A mental health challenge signified by a perpetual state of despondence or a disconnection from pleasures, notably compromising daily operations.

Despondency

A state of low mood and aversion to activity, often associated with feelings of hopelessness and sadness.

Suicidal Thoughts

Thoughts about or an inclination towards ending one's own life.

Major Depressive Disorder

A mental disorder characterized by a persistent and intense feeling of sadness or despair and/or a loss of interest in activities, often accompanied by other symptoms such as changes in sleep, appetite, and energy level.

Q4: Three Hills Partnership had profits of $210,000

Q6: It is the end of 20x8, and

Q25: Internal reports are generally<br>A) aggregated.<br>B) detailed.<br>C) regulated.<br>D)

Q28: An alkene has _ a saturated hydrocarbon

Q52: Which of the following solutions has the

Q71: Direct materials and direct labor of a

Q80: Adrenaline is responsible for the body's "fight

Q102: Which one of the following is not

Q109: In an analogous sense, external user is

Q143: Many companies have significantly lowered inventory levels