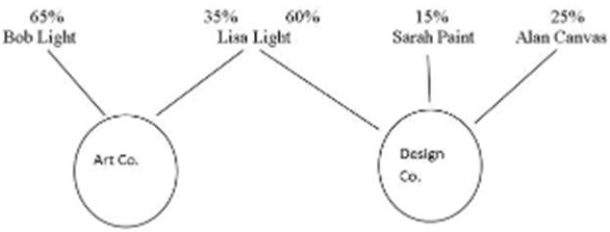

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son. Sarah Paint and Alan Canvas are not related to Bob and Lisa or to one another. All of the shares held are common shares.

In 20xx, Art Co. earned $700,000 of active business income and Design Co. earned $500,000 of active business income. Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000. Art Co. reported $100,000 of adjusted aggregate investment income in the previous year. Design Co. did not report any investment income. The two companies have decided that Design Co. will not use any of the small business deduction in 20xx. The combined taxable capital of the two corporations is less than $10 million.

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Calculate the amount available for the small business deduction to Art Co. in 20xx.

Definitions:

Q1: The inventory accounts that show the cost

Q5: ABC Co. and XYZ Co. have entered

Q9: On the cost of goods manufactured schedule,

Q11: Which of the following describes the dissolution

Q30: How many moles of magnesium chloride (MgCl<sub>2</sub>)

Q39: Benson Inc.'s accounting records reflect the

Q44: Barton Company has beginning work in process

Q63: Worth Company reported the following year-end information:

Q63: Which of the following types of molecules

Q79: Which of the following is a balanced