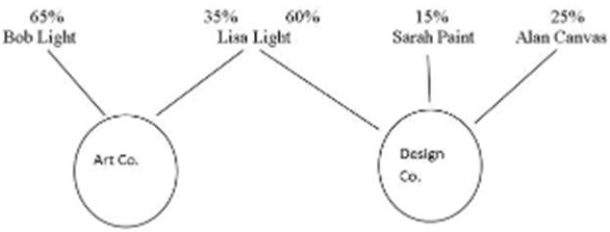

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son. Sarah Paint and Alan Canvas are not related to Bob and Lisa or to one another. All of the shares held are common shares.

In 20xx, Art Co. earned $700,000 of active business income and Design Co. earned $500,000 of active business income. Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000. Art Co. reported $100,000 of adjusted aggregate investment income in the previous year. Design Co. did not report any investment income. The two companies have decided that Design Co. will not use any of the small business deduction in 20xx. The combined taxable capital of the two corporations is less than $10 million.

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Calculate the amount available for the small business deduction to Art Co. in 20xx.

Definitions:

Last Dividend

The most recent distribution of company earnings to shareholders, expressed as a dollar per share value.

Preferred Stock

A class of ownership in a corporation with a fixed dividend that has priority over common stock dividends but typically does not have voting rights.

Par Value

The nominal or face value of a bond, share, or coupon as stated by the issuer.

Market Price

The up-to-the-minute market price for assets or services open for buy or sell transactions.

Q5: Anne owns 100% of the shares of

Q5: Mary is deciding where to invest $10,000.

Q7: Which of the following is one of

Q8: Bride and Groom Co. is a Canadian

Q23: Which skeletal line structure best represents 2-butyne?

Q43: Arsenic poisoning is a serious problem in

Q62: Product costs are also called<br>A) direct costs.<br>B)

Q66: A manager that is establishing objectives is

Q89: We can predict whether or not a

Q110: In calculating gross profit for a manufacturing