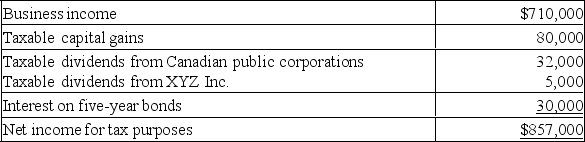

ABC Corporation ("ABC") is a Canadian-controlled private corporation and has correctly calculated its net income for tax purposes to be $857,000 for the year ending December 31, 2019, as shown below:

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.

Additional information:

- ABC made charitable donations of $45,000 during the year

- Net capital losses were $35,000 as of January 1, 2019

- Non-capital losses were $50,000 as of January 1, 2019

- At the end of the previous year, ABC had a balance in its non-eligible refundable dividend tax on hand (RDTOH) account of $18,000 and GRIP of $2,000. XYZ received a dividend refund of $1,917 from its non-eligible RDTOH when it paid its dividend of $5,000 to ABC.

- ABC calculated a dividend refund of $3,000 for the previous year, based on dividends paid in the previous year.

- Eligible dividends of $90,000 and capital dividends of $70,000 were paid by ABC on December 31, 2019. Dividends equal to the GRIP balance were designated as eligible dividends.

- For 2018, the taxable capital of ABC and XYZ, combined, was below $10,000,000. As well, the combined adjusted aggregate investment income was below $50,000.

Required:

a) Determine ABC's federal income tax payable for its 2019 fiscal year

b) Determine ABC's refundable dividend tax on hand balances at the end of 2019

c) Determine ABC's dividend refund for 2019

Definitions:

Culture

The shared patterns of behaviors, interactions, beliefs, and norms among a group of people that are passed down from generation to generation.

Norm

A standard or pattern of social behavior that is typical or expected within a specific group or society.

Moral Domains

Specific areas of moral judgment that distinguish between types of ethical or moral behavior.

Shweder

Richard A. Shweder, an anthropologist known for his work in cultural psychology and ethnopsychology, particularly regarding moral reasoning.

Q3: Hold Co. is a Canadian controlled private

Q3: Planning is a function that involves<br>A) hiring

Q6: Which of the following situations would not

Q18: What is the parent chain name of

Q22: In a colloidal dispersion, the major component

Q33: Directing includes<br>A) providing a framework for management

Q36: Which of the following molecules contains an

Q70: An electrolyte is a substance that<br>A) dissolves

Q86: Financial statements for external users can be

Q87: Which of the following statements about bases