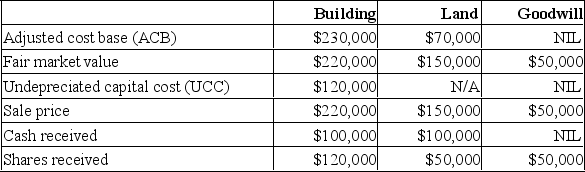

Janko Corp. has transferred the following three assets to Jumbo Corp., a Canadian controlled private corporation, under section 85 of the Income Tax Act.

Required:

Required:

Determine the following amounts:

A) The minimum amount that Janko may elect to transfer each asset in the rollover based on the information provided

B) Janko's income or loss for tax purposes as a result of the rollover

C) The ACB of the shares received by Janko following the rollover

D) The PUC of the shares received by Janko following the rollover

Definitions:

Preschool Student

A child who attends an educational establishment designed to prepare them for primary school, typically aged between 3 and 5 years.

Fifth-Grade Student

A student who is in the fifth grade, typically around 10-11 years old, in primary education systems.

Intellectual Disability

A term used for a range of developmental conditions characterized by limitations in intellectual functioning and adaptive behaviors.

Conceptual Skills

These are abilities that allow an individual to understand complex situations and develop creative solutions by thinking in abstract and strategic terms.

Q3: Jerome has a 10% interest in a

Q4: (Adapted from "Problem Eleven" from Chapter Six

Q5: Miller Co. was incorporated in 20x7. Incorporation

Q6: Raw materials inventory shows the cost of

Q39: The predetermined overhead rate is<br>A) determined on

Q56: Indirect materials and indirect labor are both

Q56: Which of the following structures is monohydrogen

Q101: Which of the following strong acids is

Q141: Which of the following is not a

Q143: Many companies have significantly lowered inventory levels