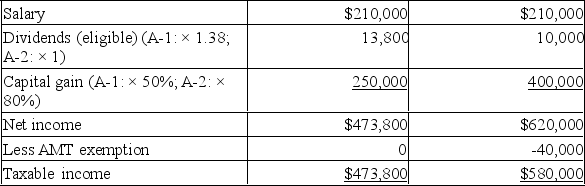

Sally earned $210,000 during 20x8. CPP and EI were deducted from her pay, totaling $3,609, and total income tax (federal and provincial) deducted was $70,000. She also received eligible dividends in the amount of $10,000. She sold shares in a public corporation during the year and recognized a capital gain of $500,000. Sally is married. Her husband earned $100,000 during the year.

Required:

A) Calculate Sally's taxable income and her federal tax liability before the deduction of any allowable non-refundable tax credits using 1) the normal method, and 2) the alternative minimum tax method.

B) Which method would allow for a deduction of the dividend tax credit?

C) Which method will Sally be required to use in 20x8, and why? How much is her federal tax liability? (Use tax rates and amounts applicable for 2019.)

Definitions:

Subjective

Based on or influenced by personal feelings, tastes, or opinions, rather than external facts.

Examiner

A person or tool that assesses someone or something in terms of quality, skill, or knowledge.

Lumen

The interior space of a tubular structure, such as an artery or intestine.

Tube-Like Organ

A hollow body part that resembles a tube in shape, facilitating the passage or transport of substances.

Q1: Graeme owns a profitable small CCPC, ABC

Q1: KM Ltd. is a Canadian-controlled private corporation,

Q4: Corporation A is selling a depreciable asset

Q5: On March 1, 20x1, Notes Inc. purchased

Q7: Which of the following is one of

Q13: Which of the following alcohols are found

Q16: Which statement best describes which characteristics of

Q24: Dolan Company's accounting records reflect the

Q45: Manufacturing costs that cannot be classified as

Q55: Adding an acid to pure water will