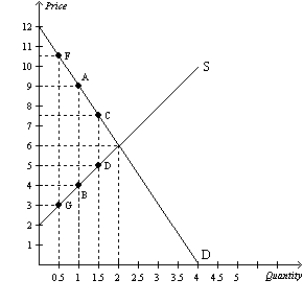

Figure 8-19

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-19.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

Definitions:

Working Memory

An intelligence system with limited abilities, focused on short-term maintenance of information for processing activities.

Maintenance Rehearsal

A cognitive process that involves repeatedly verbalizing or thinking about a piece of information to keep it in short-term memory.

Depth-of-processing Approach

A theory that suggests the depth at which information is thought about or processed affects how well it is remembered; deeper processing involves meaningful analysis and leads to better recall.

Interference Theory

The theory suggesting that the ability to remember information is affected by other learning, leading to memory interference and forgetting.

Q55: Refer to Figure 8-13. Suppose the government

Q102: Refer to Figure 9-12. Consumer surplus before

Q192: Refer to Figure 9-22. Suppose the government

Q234: Refer to Figure 8-2. The loss of

Q286: When a tax is imposed on sellers,

Q305: Total surplus = Value to buyers -

Q335: Refer to Figure 8-8. The tax causes

Q358: Refer to Figure 9-27. With no trade

Q374: Concerning the labor market and taxes on

Q495: Refer to Figure 9-21. With free trade,