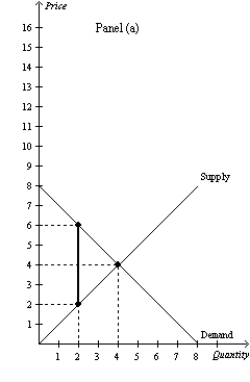

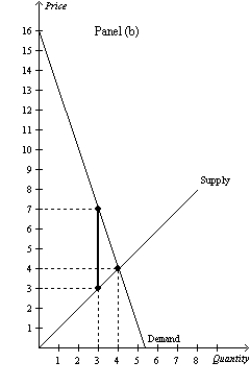

Figure 8-15

-Refer to Figure 8-15.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

Definitions:

Net Purchases

The total cost of purchases made by a company after deducting any returns, allowances, and discounts.

Cost of Goods Sold

The immediate expenses linked to manufacturing goods for sale within a business, encompassing both materials and workforce costs.

Credit Sales Transactions

Transactions where goods or services are sold to a customer with an agreement that payment will be made at a later date.

Perpetual Inventory System

An accounting method that records inventory purchases and sales in real-time, continuously updating inventory balances.

Q33: Refer to Figure 9-17. With free trade,

Q67: Refer to Figure 9-12. Producer surplus after

Q243: Refer to Figure 8-18. Suppose the government

Q255: Refer to Figure 9-29. Suppose the country

Q272: The deadweight loss from a tax<br>A)does not

Q304: Which of the following events always would

Q426: The higher a country's tax rates, the

Q438: If a tax shifts the supply curve

Q460: The optimal tax is difficult to determine

Q501: With which of the Ten Principles of