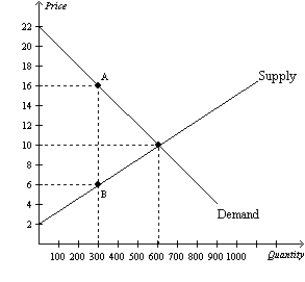

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.What happens to consumer surplus when the tax is imposed in this market?

Definitions:

Current Liabilities

Financial obligations or debts that a company is expected to settle within one year or within its operating cycle.

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances of temporary accounts to permanent accounts, preparing the books for the next period.

Depreciation Expense

This is an accounting method used to allocate the cost of a tangible asset over its useful life.

Salaries and Wages Expense

The total cost incurred by an employer for employee compensation, including both salaries and hourly wages.

Q72: If the government imposes a $3 tax

Q146: Refer to Figure 8-6. Total surplus with

Q192: Refer to Figure 8-6. The tax results

Q260: When a tax is levied on a

Q338: Refer to Scenario 8-3. Suppose that a

Q342: For widgets, the supply curve is the

Q349: Taxes on labor encourage all of the

Q364: Refer to Figure 8-7. Which of the

Q391: Suppose a tax is imposed on each

Q426: The higher a country's tax rates, the