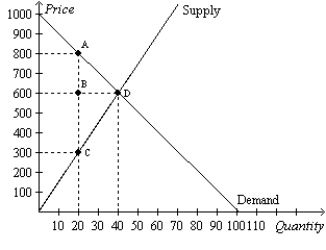

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the price received by sellers to

Definitions:

Wages

Payment to an employee from an employer for the labor or services performed, typically calculated on an hourly, daily, or piecework basis.

Salaries

Fixed regular payments made by an employer to an employee, typically expressed as an annual sum and taxed as ordinary income.

Tips

Additional money given to service workers for performed services, which is considered taxable income by the IRS.

Tax Liability

The total amount of tax owed to the government by an individual, corporation, or other entity by a specified date.

Q28: Refer to Figure 8-26. Suppose the government

Q29: A country has a comparative advantage in

Q71: The Laffer curve relates<br>A)the tax rate to

Q88: Refer to Figure 7-12. If the equilibrium

Q93: Illustrate on three demand-and-supply graphs how the

Q102: Total surplus in a market will increase

Q178: A tariff is a<br>A)limit on how much

Q349: Refer to Figure 7-17. If the demand

Q405: Refer to Figure 7-10. Which area represents

Q412: Suppose a tax of $1 per unit