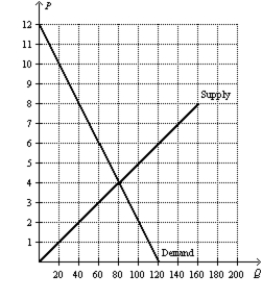

Figure 8-26

-Refer to Figure 8-26.Suppose the government places a $3 tax per unit on this good.How many units of this good will be bought and sold after the tax is imposed?

Definitions:

Short-term Loans

Loans that are scheduled for repayment within a short timeframe, usually less than one year.

Accounts Receivable

Accounts receivable refers to the money owed to a company by its customers for goods or services delivered but not yet paid for, representing a line of credit from the company to the customer.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term health and efficiency of its operations.

Spontaneous Financing

Financing that arises naturally from the operations of a company, such as trade credit that increases as sales grow, without requiring explicit negotiation or arrangements.

Q15: Refer to Figure 8-1. Suppose the government

Q34: Refer to Figure 7-25. At the equilibrium

Q66: Refer to Figure 8-27. Suppose that Market

Q83: Refer to Figure 8-9. The consumer surplus

Q160: If a tax shifts the demand curve

Q213: Allen tutors in his spare time for

Q219: Refer to Figure 7-23. If the price

Q233: Suppose a tax is imposed on bananas.

Q389: Refer to Figure 8-2. The amount of

Q426: We can say that the allocation of