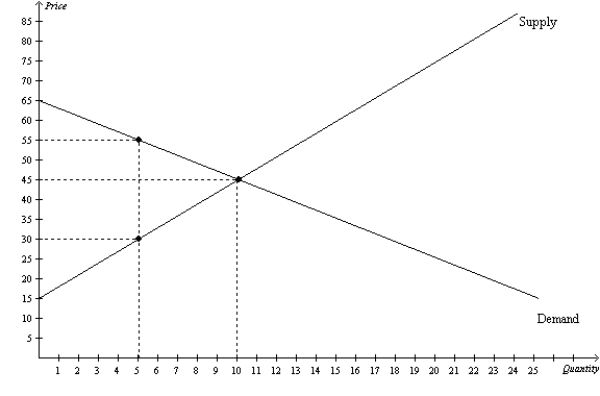

Figure 7-19

-Refer to Figure 7-19.At the equilibrium price,total surplus is

Definitions:

Progressive Federal Income Tax

A tax system where the tax rate increases as the taxable amount (income) increases, applied at the federal level.

Government's Revenue

The total financial income collected by the government from various sources, including taxes, fees, and investments.

Excise Tax

A tax levied on specific goods, services, or transactions, typically aimed at discouraging consumption of certain items or raising revenue.

Demand Curves

Graphical representations showing the relationship between the price of a good and the quantity demanded by consumers, typically illustrating an inverse relationship.

Q30: Consumer surplus can be measured as the

Q55: Refer to Figure 8-13. Suppose the government

Q109: To fully understand how taxes affect economic

Q343: Using demand and supply diagrams, show the

Q366: Refer to Figure 7-27. If the government

Q373: Refer to Figure 8-3. The amount of

Q426: We can say that the allocation of

Q473: Refer to Table 7-14. You want to

Q474: Refer to Figure 7-6. At the equilibrium

Q545: Refer to Table 7-5. If the market