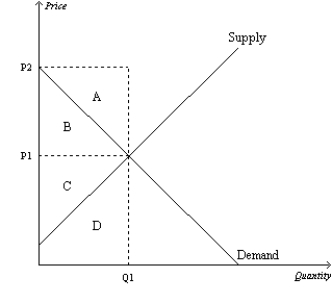

Figure 7-21

-Refer to Figure 7-21.When the price is P1,area B+C represents

Definitions:

Yield To Maturity

The total return anticipated on a bond if it is held until the date it matures, taking into account both current interest payments and the gain or loss upon redemption.

7% Bond

A bond that pays 7% interest annually on its face value.

Current Yield

A financial ratio that shows the annual dividend rate of a security divided by its current market price.

9% Bond

A bond that pays an annual interest rate of 9% to its holder.

Q9: Refer to Figure 8-29. As the size

Q127: Refer to Figure 7-15. Suppose producer surplus

Q147: A binding price ceiling may not help

Q250: Suppose a tax of $1 per unit

Q255: When a tax on a good is

Q323: The deadweight loss from a $3 tax

Q366: To be binding, a price ceiling must

Q392: Refer to Table 7-7. You have four

Q492: Refer to Figure 8-12. Suppose a $3

Q522: Refer to Figure 7-7. What is the