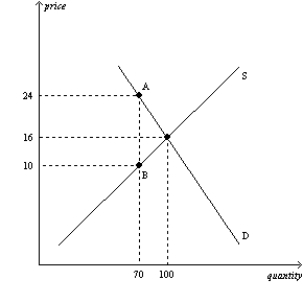

Figure 6-18

The vertical distance between points A and B represents the tax in the market.

-Refer to Figure 6-18.The effective price that sellers receive after the tax is imposed is

Definitions:

Activity-Based Costing

A costing method that assigns costs to products or services based on the activities they require, aiming to provide more accurate cost information.

Unused Capacity

Refers to the part of a company's production capability that is not currently being used for production. It indicates resources that are currently idle and not generating revenue.

Activity-Based Costing

An accounting method that assigns overhead and indirect costs to related products and services based on the activities that generate costs.

Activity Cost Pools

Accumulations of costs categorized by activity (such as ordering materials or setting up machines), used in activity-based costing to allocate costs more accurately.

Q13: Refer to Figure 6-2. The price ceiling<br>A)is

Q128: Refer to Table 7-8. The price that

Q188: Lawmakers designed the burden of the FICA

Q192: The Surgeon General announces that eating chocolate

Q214: A binding minimum wage tends to<br>A)cause a

Q225: Refer to Table 7-18. If the market

Q370: Refer to Table 7-7. You have two

Q512: A price ceiling is always a binding

Q551: When a price ceiling is binding, is

Q628: If a tax is levied on the