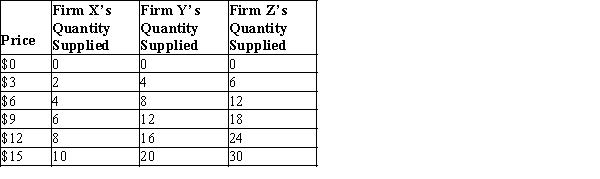

Table 4-8

-Refer to Table 4-8. Suppose Firm X and Firm Y are the only two sellers in the market. If the market price increases from $12 to $15, quantity supplied will

Definitions:

Cash Inflow

refers to the movement of money into a business, often from operations, financing, or investing activities, contributing to the company's cash balance.

Cash Outflow

The movement of money out of a business, project, or investment, usually in the form of expenses, purchases, or cash distributions.

Cash Flow Ratio

A metric that assesses the liquidity of a company by comparing its operating cash flow to its current liabilities.

Q23: Most studies have found that tobacco and

Q97: What will happen to the equilibrium price

Q102: What would happen to the equilibrium price

Q333: When quantity demanded has increased at every

Q334: The principle of comparative advantage states that,

Q452: Which of the following events would unambiguously

Q488: Opportunity cost refers to how many inputs

Q569: Refer to Figure 4-5. Which of the

Q626: In a market, to find the total

Q654: Refer to Figure 4-31. At a price