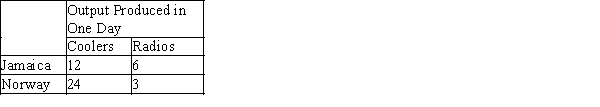

Table 3-21

Assume that Jamaica and Norway can switch between producing coolers and producing radios at a constant rate. The following table shows the number of coolers or number of radios each country can produce in one day.

-Refer to Table 3-21. Assume that Jamaica and Norway each has 4 days available for production. Originally, each country divided its time equally between the production of coolers and radios. Now, each country spends all its time producing the good in which it has a comparative advantage. As a result, the total output of radios increased by

Definitions:

Equipment Leased

Assets acquired for use over a specified period through a rental agreement, where ownership remains with the lessor.

Accumulated Depreciation

The cumulative depreciation of an asset up to a single point in its life, representing the wear and tear or obsolescence.

Operating Lease

A lease agreement that does not transfer the risks and rewards of ownership, treated as a rental expense in the lessee's income statement.

Direct Financing Lease

A type of lease where the lessor records the present value of lease payments as a receivable, effectively transferring all risks and rewards of ownership.

Q3: Refer to Figure 3-7. If Bintu and

Q67: Refer to Figure 3-20. Canada has a

Q86: Refer to Table 3-41. If the two

Q185: Charlotte can produce pork and beans and

Q205: The production possibilities frontier shows the opportunity

Q235: Refer to Table 3-23. The farmer should

Q463: If a decrease in income increases the

Q476: Refer to Figure 3-16. Hosne should specialize

Q618: When it comes to people's tastes, economists

Q678: "Other things equal, when the price of