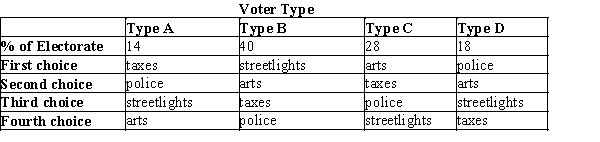

Table 22-23

The town of Franklin is facing a severe budget shortage. The town administrator has proposed four options to balance the budget: increase property taxes (taxes), cut the school arts budget (arts), turn off half of the streetlights in the town (streetlights), reduce police patrols (police). Exactly one of the four choices will prevail, and the choice will be made by way of pairwise voting, with the majority determining the outcome on each vote. The preferences of the voters are summarized in the table below.

-Refer to Table 22-23. If a Borda count is used, which option will win?

Definitions:

Social Security Withholding

The process by which employers deduct a portion of an employee's salary to contribute to the Social Security program.

Federal Income Tax Withholding

The amount of federal income tax withheld from an employee's paycheck, based on their earnings and tax filing status.

Net Pay

The amount of money remaining from an employee's gross pay after deductions like taxes, insurance premiums, and retirement contributions have been subtracted.

FICA Tax

A U.S. federal payroll (or employment) tax imposed on both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, disabled people, and children of deceased workers.

Q3: Pedro, who knows nothing about construction, paid

Q27: Which of the following events best exemplifies

Q141: If we observe that a consumer's budget

Q167: Refer to Figure 21-9. If the price

Q176: When markets fail, which of the following

Q191: Suppose the voters in a small country

Q193: Refer to Table 22-5. If (1) the

Q364: Refer to Table 22-16. If Mr. Johnson

Q463: Pete consumes two goods, rice and fish.

Q561: A budget constraint illustrates the<br>A)prices that a