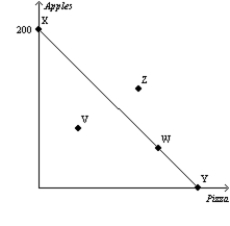

Figure 21-2 The downward-sloping line on the figure represents a consumer's budget

constraint.

-Refer to Figure 21-2. Which of the following statements is correct?

Definitions:

Taxable Income

The portion of an individual's or entity's income used to calculate how much tax they owe to the government in a given tax year.

Deductions

Amounts that can be subtracted from total income for tax purposes, effectively reducing the taxable income.

Exemptions

Provisions that allow individuals or entities to be relieved from an obligation, such as taxes, previously imposed on them.

Corporate Income Taxes

Taxes imposed on the net income (profits) of corporations by the government.

Q125: Suppose Caroline will only drink a cup

Q167: The poverty line in the country of

Q184: Assume that goods X and Y are

Q230: People with hidden health problems are more

Q236: Suppose a consumer has an income of

Q342: When the price of an inferior good

Q393: Indifference curves that cross would suggest that<br>A)the

Q471: If Walter has one hour of leisure

Q500: Refer to Figure 21-25. Suppose the price

Q505: Dave consumes two normal goods, X and