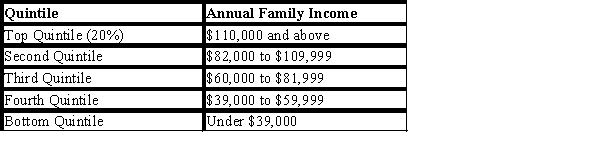

Table 20-13

The following table shows the distribution of income in Widgetapolis.

-Refer to Table 20-13. If the poverty line were $45,141, what would be the poverty rate?

Definitions:

CCA Tax Shield

The reduction in taxable income for Canadian businesses, derived from depreciating assets over time under Canada's Capital Cost Allowance regime.

Required Rate of Return

The lowest yearly percentage gain that convinces individuals or corporations to invest in a specific security or initiative.

After-tax Cash Flow

The amount of money a company has after it has paid taxes, representing the net cash inflow or outflow from its operating, investing, and financing activities.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on income, capital gains, or other taxable entities.

Q31: Government vouchers to purchase food, also known

Q36: Which of the following statements illustrates diminishing

Q60: Binding minimum-wage laws<br>A)are costly for the government

Q79: High-school athletes who skip college to become

Q171: While pollution regulations yield the benefit of

Q176: Bill is restoring a car and has

Q177: A government policy aimed at protecting people

Q183: In the United States, the overall level

Q222: The theory of consumer choice examines how<br>A)firms

Q265: Outline the possible work disincentives created by