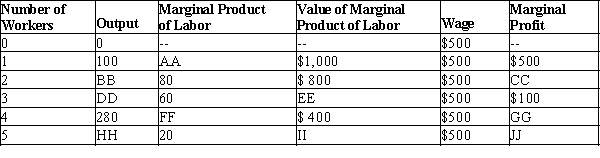

Table 18-7

-Refer to Table 18-7. What is the value for the cell labeled BB?

Definitions:

Corporate Income Taxes

Taxes levied on the net income (profit) of corporations by the government.

Federal Tax Revenues

Federal tax revenues are the funds collected by the government from taxes, including income taxes, corporate taxes, and other levies, used to fund public services and government operations.

Personal Income Taxes

Taxes imposed by governments on individual earnings, such as wages, salaries, and other forms of income, with rates that typically vary according to income levels.

Tax Structure

The system or arrangement of various types of taxes imposed by a government, including their rates, bases, and method of collection.

Q89: Suppose two companies own adjacent oil fields.

Q162: Refer to Scenario 17-5. If the restaurant

Q177: As a result of increasing its workforce

Q198: The Clayton Act of 1914 allows those

Q307: To say that a firm is competitive

Q319: A worker's contribution to a firm's revenue

Q430: A profit-maximizing competitive firm will hire workers

Q465: Refer to Table 17-1. What is the

Q560: Refer to Table 18-7. What is the

Q578: Labor-augmenting technology causes which of the following?