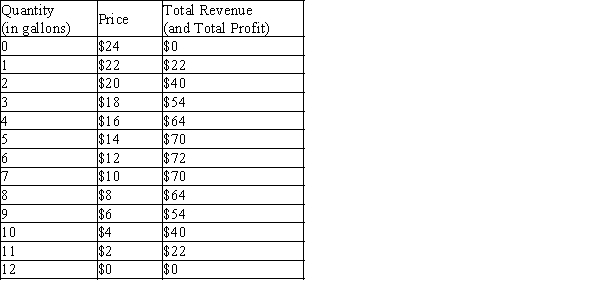

Table 17-3

Imagine a small town in a remote area where only two residents, Maria and Miguel, own dairies that produce milk that is safe to drink. Each week Maria and Miguel work together to decide how many gallons of milk to produce. They bring milk to town and sell it at whatever price the market will bear. To keep things simple, suppose that Maria and Miguel can produce as much milk as they want without cost so that the marginal cost is zero. The weekly town demand schedule and total revenue schedule for milk is shown in the table below:

-Refer to Table 17-3. If this market for milk were perfectly competitive instead of monopolistic, what would be the price for milk?

Definitions:

Medium-Term Bond

A bond with a maturity period typically ranging from 5 to 10 years, serving as an investment option between short-term and long-term bonds.

Years to Maturity

The remaining time until a financial instrument, such as a bond, reaches its maturity date and the principal must be repaid.

Convertible Bond Issue

A convertible bond issue is a type of debt security that can be converted into a predetermined number of the issuer's equity shares at certain times during its life, according to specified conditions.

Fixed Rate Coupon

A bond feature that pays the holder a fixed interest rate over the life of the bond, leading to predictable interest income.

Q53: In the case of oligopolistic markets, self-interest

Q90: Reaching and enforcing an agreement between members

Q223: Firms that sell highly differentiated consumer goods,

Q265: Refer to Table 17-19. What is grocery

Q364: If the members of an oligopoly could

Q385: Game theory is necessary to understand which

Q390: Considering perfect competition, monopolistic competition, and monopoly,

Q441: A Nash Equilibrium is a stable outcome

Q468: As the number of firms in an

Q476: There is general disagreement among economists about